All firms, from small and medium-sized enterprises (SMEs) to multinationals in every industry, want to buy and sell safely and also have the funds to buy and invest the proceeds of sale wisely. Banks want to be fully digital, drive higher self-service adoption, remain the principal banker of their customers, and upsell and cross-sell their offerings.

Wouldn’t it be great if your banking experience shows actual understanding, even anticipation, of what the business is trying to achieve? Contextual banking fulfills both these needs.

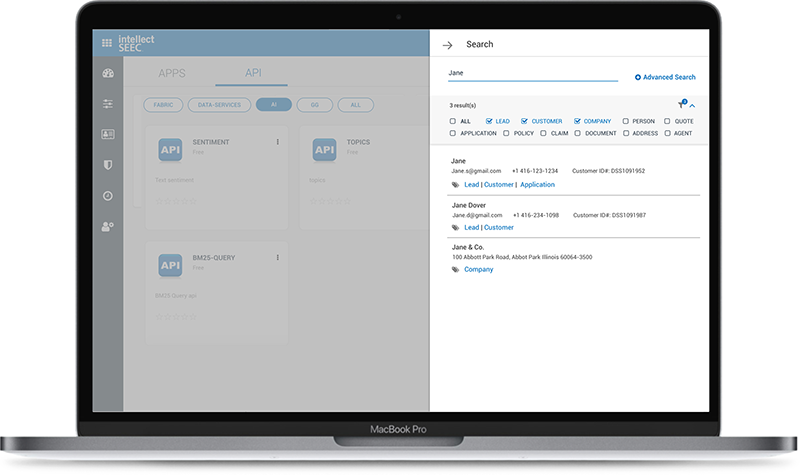

All our products are contextual and a white-label digital banking platform to manage firms’ every need that leverages Machine Learning, Artificial Intelligence and Predictive Analytics, delivered through APIs and an omnichannel UX. Our products provide over 1000 user journeys that span the full complexity of banking as microservices and UI components. This enables banks to accelerate customer self-service and both upsell and cross-sell their services by providing clients with context-aware recommendations on the best-next action or best-next offer needed to meet their immediate objectives.

API first. UX led.

Cloud native.

Prepare to comply. Prepare to complete.

60+ APIs available.

Reduce Complexity, Decrease Costs,

Accelerate Innovation.

Your clients are.

Integrated cash and trade

World-class UX drives high self-service adoption

Can a bank provide the right insights necessary to enhance their clients’ cash conversion cycles? Can you enable them to proactively sustain the financial health of their enterprise with accurate forecasts of immediate shortfalls and currency status?

The First and Only Integrated Platform, it allows banks and clients to carry out all trade and supply chain operations from a single place. Most buyers are also sellers and vice versa, and clients can carry out both operations with one unified interface and ease.

Trade & Supply Chain (TSC) can stretch across entities, platforms and geographies. Banks can deploy a global finance hub, whose regional set-ups comply with domestic regulations, with workflows optimised at all levels.

Complete flexibility in the way banks charge clients makes them more competitive. Banks can automate fees, based on region and entity, and can also offer attractive plans for transactions, such as a fixed percentage or amount, or slabs based on the amount and tenure. Banks can coordinate every pricing model in a single screen.

Read More Request a Demo

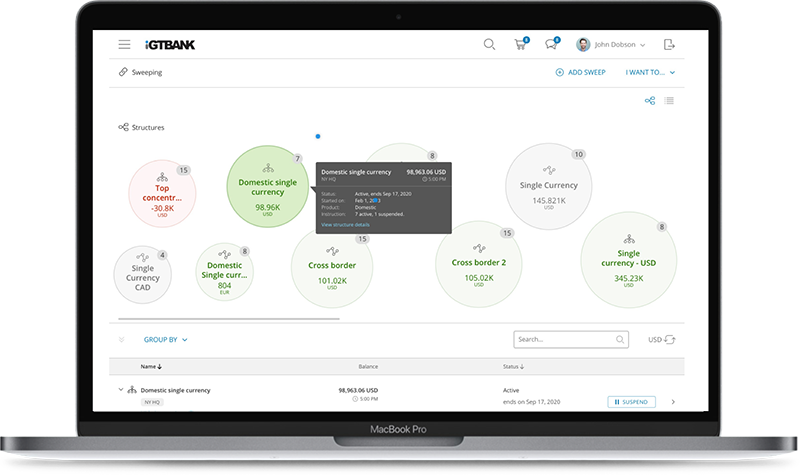

Win that elusive RFP by having just the right cross-entity, cross-currency, cross-country structure to offer. Not just cash control but investments, deposit management, forecasts and operational account management.

Set the policy and the rest is automatic. For example, intelligent best-next action logic that ensures monies are only invested into risk-appropriate and permitted products. Elevate the daily tasks of your clients’ staff above the onerous management of its accounts across the globe’s time zones.

Read More Request a Demo

Offer a true cash management solution for corporate banking through the loosely-coupled, workflow-connected channel aggregation and orchestration (payments hub), end-to-end payment processing (engine), and format conversion on your/our digital portal.

A consistent experience yet optimised for performance by configuring criteria for throttling and priority. Instill real-time payments easily using the optimised and API-first design that supports the convergence of single-message and file-based payments needed to manage the spectrum of C2C to B2C to B2B customer journeys.

Read More Request a Demo

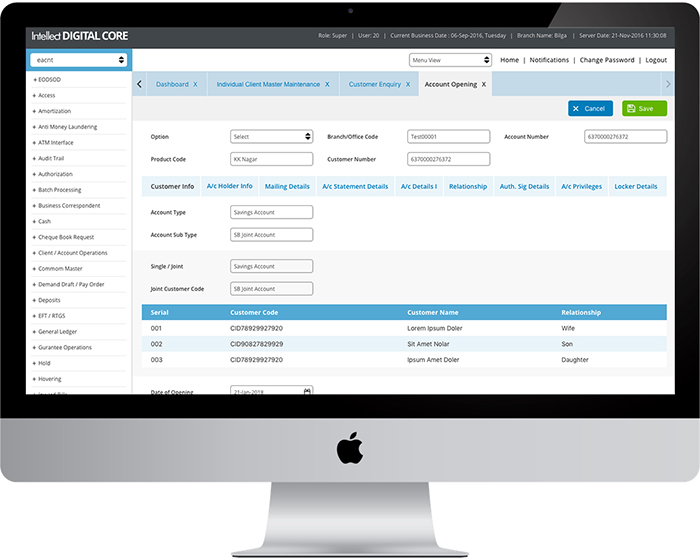

Intellect Digital Core (IDC) is a fully integrated solution across Core, Lending, Treasury, Trade Finance and Cards. Designed around the powerful Digital 360 approach, IDC presents banks with the best of both worlds i.e. Customer Experience (Digital Outside) & Operational Efficiency (Digital Inside). It leverages contemporary technologies that enable banks to offer highly contextual (persona based) products & experiences on one hand, and drive complete STP (Lean Operations) & significantly lower operating costs on the other. Built on a modular design, the highly comprehensive solution helps banks progressively modernise and drive their Digital Transformation agenda.

Read More Request a Demo

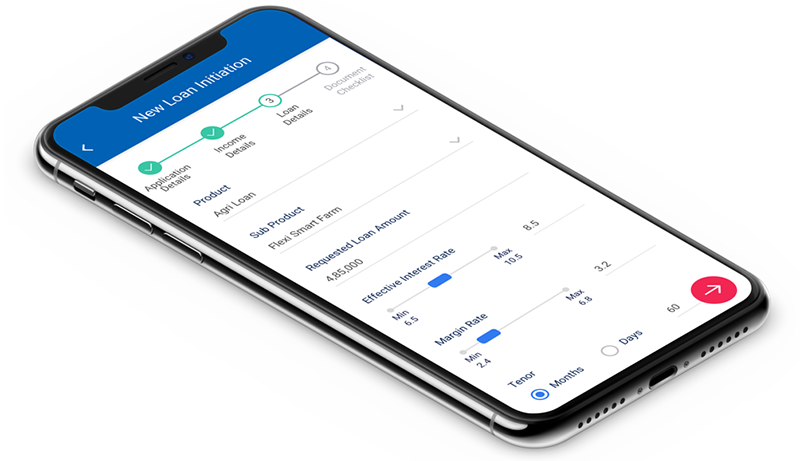

Intellect Digital Lending provides a comprehensive and configurable credit management solution designed to meet the ever-changing needs of credit seekers as well as financial institutions. It enables banks to offer commodity as well as specialised credit products across retail, corporate and small and medium-sized enterprise (SME) segments.

Product configurability, ready-to-use product templates, intelligent insights, et al are some of the capabilities that have helped our customers adopt the solution rapidly, launch new products quickly, and manage risks optimally.

Intellect Digital Lending is an all-in-one loan management system. However, specific components like loan origination, loan management and collection are also available as standalone products to suit the varying needs of customers at different levels of transformation.

Read More Request a Demo

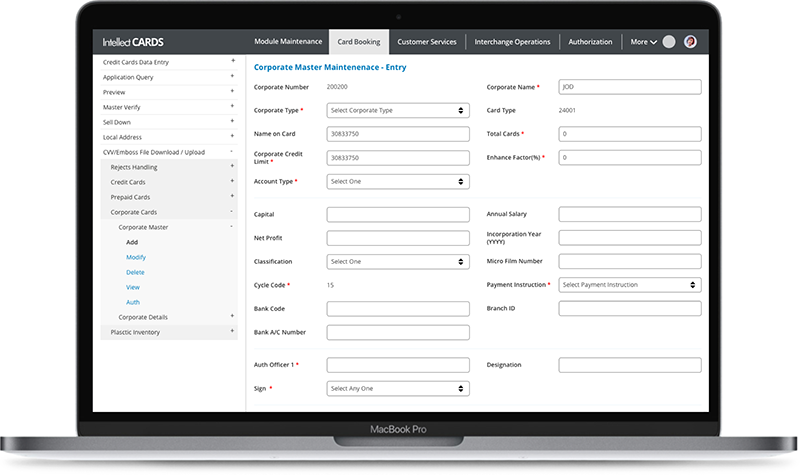

Intellect Cards is a comprehensive, fully digital Payment Card Application that addresses all credit card, debit card, prepaid card and retail card business needs across issuing, acquiring, fraud monitoring, loyalty management and delinquency management. Compliant to latest EMV standards and supporting VSDC 1.4.1 and MCHIP 4.0 specification, it also supports traditional magnetic stripe cards along with latest chip-based EMV cards.

Intellect Cards offers both the license model option, as well as the private and public cloud option. The banks/financial institutions can choose to also avail of back-end operations services from Intellect, thus offering cost-beneficial as well as quick to market solutions.

Request a Demo

Intellect Digital Wealth (Wealth Qube) is an integrated front, middle and back office solution for private banks, wealth management firms, advisory firms, broker dealers & independent financial advisors. It can be deployed in a modular fashion across multiple delivery channels, leveraging existing IT investments.

Intellect Wealth suite supports prospect & client management, asset allocation & financial planning, portfolio management, performance analytics, advisor workstation, lending against collaterals, accounting and reporting.

Read More Request a Demo

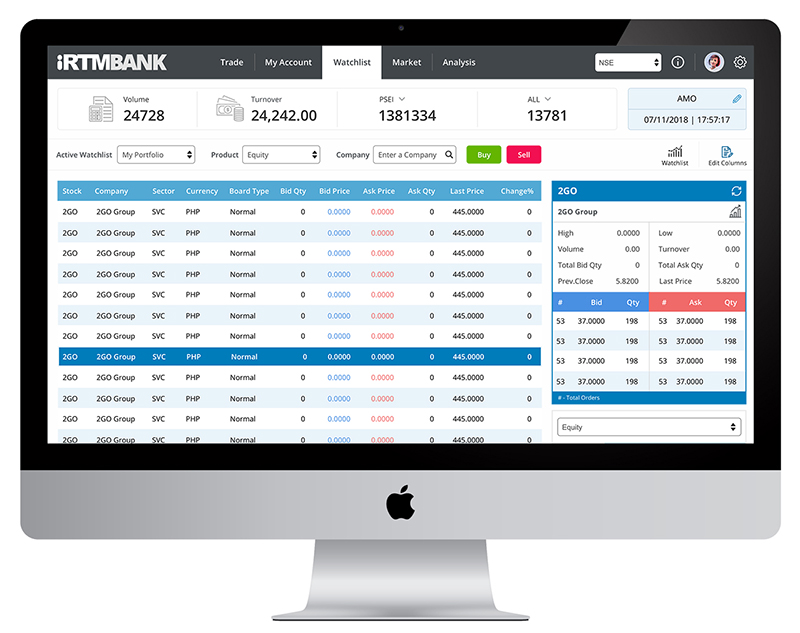

Capital Alpha is a multi-asset, multi-exchange, multi-channel, multi-currency, multi-lingual integrated platform providing contextual and real-time trading, aided by online market rates and news, extensive and Artificial Intelligence based analytics, and research on your fingertips. It insulates the investor and the broker from market risk and adheres to the compliance requirements. A sturdy back office ensures operational efficiency through increased Straight Through Processing (STP) index and reduces operational risks. Built on future-proof technology with ready adapters to market entities ensures speedy implementation.

Read More Request a Demo

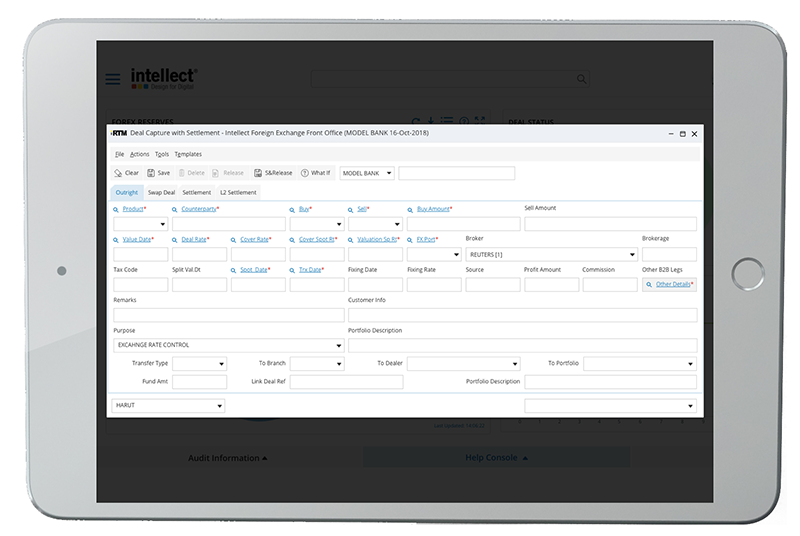

Treasury has a critical role to play in shaping bank’s strategy, as it is the treasurer who has to monitor the liquidity exposures, manage balance sheet volatility, maintain the capital buffers and comply with a slew of regulatory requirements, while contributing as a strategic partner to the business.

Disparate systems and silos hamper the growth objective of the treasurer. An Integrated Treasury & Asset and Liability Management (ALM) with real-time view of exposures and risk, aiding rapid decisions is the need of the day.

‘Capital Cube’, is an Integrated Treasury & Asset and Liability Management (ALM) solution, that aids the treasurer to strategically manage the balance sheet, adapt to regulatory regimes, optimise liquidity and leverage risk to maximise profits for the bank.

Read More Request a Demo

Intellect FABRIC, our cloud-native, Machine Learning based Insurtech platform is proven on a global scale. It powers multiple products like Risk Analyst and Xponent for P&C Insurance, Distribution and Service Suite and Claims for Life Insurance.

Fabric ensures that high-performance and security is provided in a cost-effective manner which has led us to create award-winning solutions for our customers.

Intellect Xponent is an Artificial Intelligence (AI) and Analytics based underwriting workstation, developed to transform the way commercial lines are underwritten today. By bringing in the latest exponential technologies to Insurance, Xponent is meant to provide underwriters with an effective and efficient way to assess the impact of risk. It is also meant to create a faster and seamless experience for agents to retrieve status of applications and a quick turnaround time for customers.

Read More Request a Demo

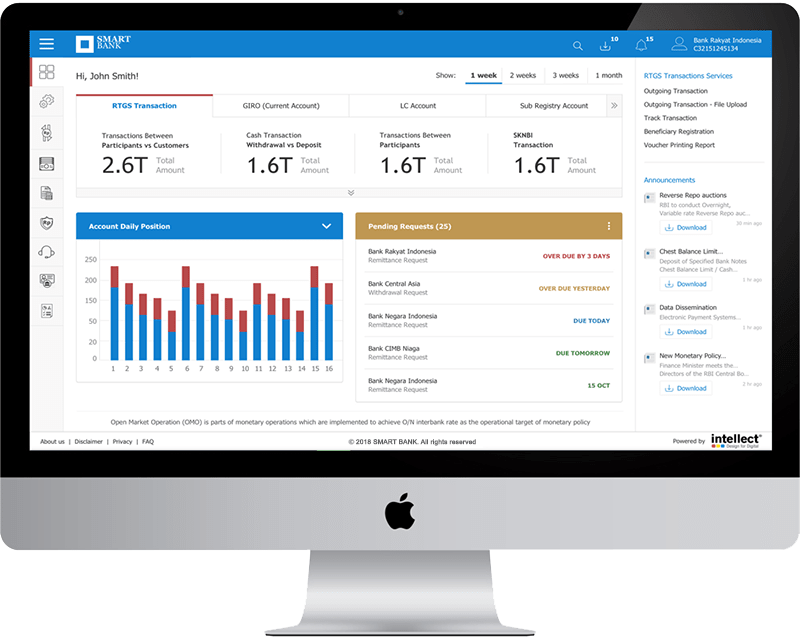

Intellect Quantum is designed specifically for Central Banks, which is aimed at reducing complexity. The underlying technology design drives four things: Real-Time informed decision making & Risk Management, Unmatched Configurability for speed and ease of change, Tightly integrated analytics and Non-Compromising security.

The product empowers Central Banks to take a Quantum leap in their progressive transformation journey through a formidable range of instruments including Currency Management, Public Debt & Depository Management, Enterprise General Ledger & Collateral Management.

Our award-winning Quantum Central Banking Solution has successfully modernised many Central Banks across the world including Reserve Bank of India, Central Bank of Sweden (Sveriges Riksbank), National Bank of Ethiopia, Central Bank of Lesotho and Central Bank of Seychelles.

Read More Request a DemoFor over a decade, Intellect has been designing and deploying rich global Intellectual property and robust platforms and products. With a presence in major financial hubs around the world, Intellect's high performance technology solutions are running in over 200 financial institutions.

LinkedIn

LinkedIn Twitter

Twitter